Launching a Credit Repair Business: A Guide to Success | Client Dispute Manager Software

Client Dispute Manager offers the resources and tools you need to start your own credit repair business. Take the first step towards entrepreneurship and make a difference in the lives of others.

More on YorkPedia:

- Explore the sites in San Antonio with help from Ocean Beach Travel

- Get Ready to Witness the Exclusive Blend of DUB-FUNK Vibes With KingZiLLa ft.BRO.BLAKE’s ‘Deadly Beginning’

- Enjoy Short Stays in Turkey with The Newly Improved Turkish eVisa

- Get a US Online Visa from Every Corner of the World

- Viviana Brignoni, DMD, a Periodontist with Beyond Periodontics, LLC

(YorkPedia Editorial):- Fort Lauderdale, Florida Feb 2, 2023 (Issuewire.com) – Client Dispute Manager Software:

Launching a credit repair business can be a fulfilling endeavor, but it requires more than just a passion for helping others improve their credit scores. The credit repair industry is highly competitive and can be challenging to navigate, especially for those who are new to the field. However, with the right strategies and tools, you can start a credit repair business that stands out from the competition and secure a better future for you.

Are you ready to take the first step toward starting your own credit repair business? Here are some key strategies to help you get started on the right foot.

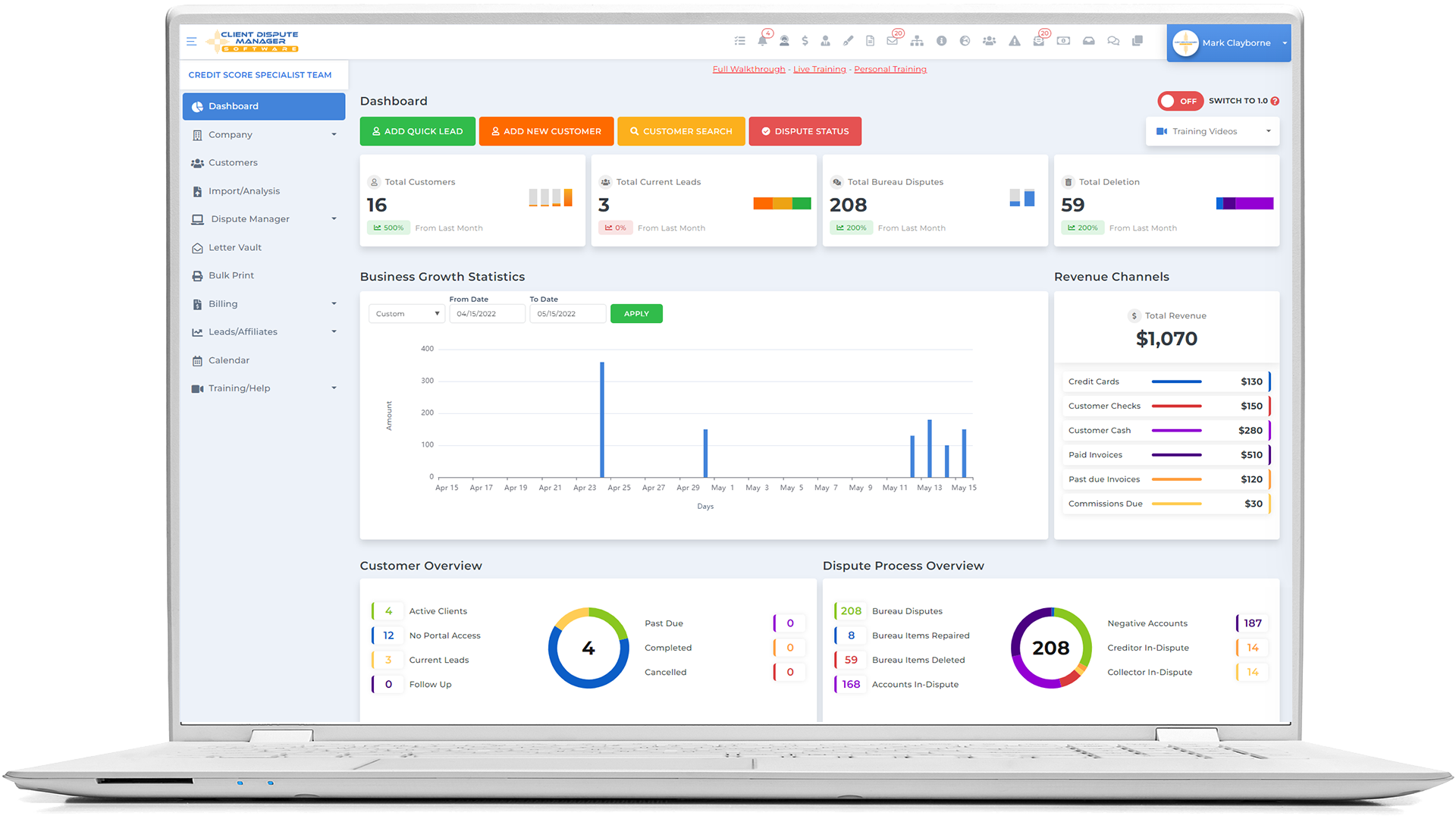

- Invest in the Professional Credit Repair Software

One of the most important investments you can make when starting a credit repair business is professional credit repair software. This software will help you automate many of the tedious and time-consuming tasks associated with credit repairs, such as dispute letter generation and credit bureau communication. With the right software, you can streamline your workflow and focus on growing your business.

But how do you choose the right credit repair software? Look for software that is user-friendly and easy to navigate, has a wide range of features and integrations, and is backed by a knowledgeable support team. Good software will also have a built-in CRM to help you manage clients’ data and track their progress.

- Understand the Credit Repair Process

It’s vital to have a comprehensive understanding of the credit repair process if you want to launch a successful credit repair business. This includes knowing how credit scores are calculated, what factors contribute to a low credit score, and the various credit repair services you can offer.

The credit repair process typically involves analyzing credit reports, identifying errors and inaccuracies, and disputing them with the credit bureaus. It’s essential to stay up-to-date on the latest credit repair laws and regulations, such as the Credit Repair Organizations Act (CROA) and the Fair Credit Reporting Act (FCRA). Understanding these laws will help you avoid legal issues down the line.

- Build a Strong Online Presence

In today’s digital age, having a strong online presence is essential for any business, including credit repair businesses. Potential clients are likely to search for credit repair services online, so it’s crucial to have a website that’s professional, user-friendly, and informative.

Your website should include a clear and concise overview of your services, pricing, and contact information. It’s also a good idea to include testimonials from satisfied clients and a blog with relevant content, such as tips on improving credit scores and common credit repair misconceptions.

Social media platforms like Facebook and Instagram can also be a great way to connect with potential clients and build your brand. Use these platforms to share helpful tips and information, as well as updates on your business.

- Offer a Free Consultation

One of the best ways to attract new clients is by offering a free consultation. This gives potential clients a chance to learn more about your services and see how you can help them improve their credit scores.

During the consultation, be sure to ask questions and listen actively to your client’s concerns. This will help you identify the specific credit issues they’re facing and tailor your services to meet their needs. It’s also an opportunity to build trust and establish yourself as a credible and reliable credit repair expert.

- Follow Up With Clients

Once you’ve landed a new client, it’s essential to follow up with them regularly to ensure they’re satisfied with your services and to track their progress. This can be done via email, phone, or in-person meetings.

Following up with clients also helps you build a strong relationship with them and keep them updated on any changes to their credit scores. It’s also a good opportunity to upsell additional services, such as credit monitoring or credit education.

- Network and Market Your Business

Starting a credit repair business is not only about providing the service but also about marketing it correctly. Networking and marketing are crucial for growing your business and reaching new clients. Attend local networking events, join online forums, and reach out to other businesses in your community to build relationships and promote your services.

You can also offer referral incentives to current clients who refer new clients to your business. This not only helps you acquire new clients but also ensures that your current clients are happy with your services.

- Keep Your Business Compliant

As a credit repair business, it’s essential to stay compliant with all state and federal laws and regulations. This includes obtaining the necessary licenses and certifications and following all laws related to credit repairs, such as the CROA and FCRA.

It’s also important to have a clear and transparent pricing structure and to provide clients with a written contract outlining the services you will provide and the terms of your agreement. This helps protect both you and your clients and ensures that everyone is on the same page.

Starting a credit repair business requires hard work and dedication, but can be a rewarding endeavor. By investing in professional credit repair software, understanding the credit repair process, building a strong online presence, offering a free consultation, following up with clients, networking and marketing, and staying compliant, you can start a credit repair business that stands out from the competition and have a stable career.

Conclusion

Opening a credit repair business may seem challenging, but with the right strategies and tools, you can establish a credit repair business that is effective and well-run. Remember, providing excellent services, staying compliant, and marketing your business correctly are key.

Bonus

Do you have a passion for helping others improve their credit scores and achieve financial stability? At Client Dispute Manager, we offer the resources and tools you need to start your own credit repair business. Take the first step towards entrepreneurship and make a difference in the lives of others.

Be your own boss. Set your own schedule and travel when you want. Start a credit business today. Click here to get everything you need for FREE. https://www.clientdisputemanager.com/register

Media Contact

Client Dispute Manager Software

888-959-1462

2598 E Sunrise Blvd, Suite 2104, Fort Lauderdale 33304, Florida